For Maryland millennials, the decision between renting and buying a home is more than just a

choice about where to live—it’s a pivotal financial decision with long-term implications. With the

weight of housing costs pressing down, it’s no surprise that 3 in 10 young people are

contemplating leaving the state.

However, amid these challenges, there are still affordable opportunities for renting, providing a

pathway to homeownership with careful planning and consideration. In this blog, we’ll delve into

the essential factors Maryland young adults need to know as they navigate this critical decision,

offering insights and guidance to help them make informed choices for their future.

Understanding the Current Market: Real Estate and Rental Trends in Maryland

The Maryland Real Estate Market

Maryland’s real estate market has witnessed a steady incline in home prices over the past few

years. The rising prices have been driven by a combination of factors, including a low supply of

available houses coupled with a population growth rate that outpaces the rate of new home

construction. As a result, the median sale price for homes in Maryland has continued to rise

steadily, with properties spending very little time on the market.

Key Considerations:

- Increasing Home Prices: Home prices in Maryland have surged by 8.3% compared to

last year, bringing the median sale price to $412,400. This significant increase reflects

the high demand for housing in the state. - Limited Housing Supply: A critical factor contributing to escalating home prices is the

imbalance between housing supply and demand. Maryland has struggled to keep pace

with its population growth, building fewer than 15,000 housing units annually since 2008,

while the population expands by approximately 40,000 residents each year. Read more about the Maryland housing market on Forbes.com - Fast-Paced Market: Homes in Maryland typically sell swiftly, often attracting multiple

offers and selling above the asking price. This competitive landscape underscores the

challenges faced by prospective buyers seeking to enter the market. - Closing Costs: Prospective buyers must factor in additional expenses, including closing costs, which in Maryland amount to approximately 3.7% of a home’s list price.

Understanding and budgeting for these costs is crucial for informed decision-making.

Governor Wes Moore has taken proactive measures to address housing affordability. These efforts include initiatives to encourage the construction of denser housing projects, with a focus

on expediting the development process, particularly for projects incorporating a percentage of affordable housing units.

While Maryland’s real estate market remains highly competitive, prospective buyers can explore

areas where housing is more affordable and leverage available resources and initiatives to

make informed decisions about their housing needs and financial future.

The Maryland Rental Market

While the real estate market is highly competitive for buyers, the rental market in Maryland

offers a mix of opportunities and affordability.

Key Considerations:

- Some Stability Amidst Rising Costs: Despite the overall increase in housing costs,

rental prices have shown some stability or even slight declines in many areas of

Maryland. This trend provides renters with the opportunity to find housing options that fit

their budget while they save up for future homeownership. - Rental Trends in Different Regions: The average rental cost in Maryland stands at

around $1,870, with slight fluctuations observed in different regions. For example, cities

like Baltimore, Silver Spring, and Laurel have median rents under $2,000, making them

more affordable options for renters.

Monthly Payment Breakdown: Renting vs. Buying in Maryland

For millennials aiming to bolster their wealth, purchasing a home is a savvy investment in their financial future. Homeownership provides a platform for significant financial growth and security because each mortgage payment not only covers housing expenses but also incrementally builds equity in the property. It’s a smart move that empowers millennials to lay a solid foundation for their financial portfolios and achieve their wealth-building goals.

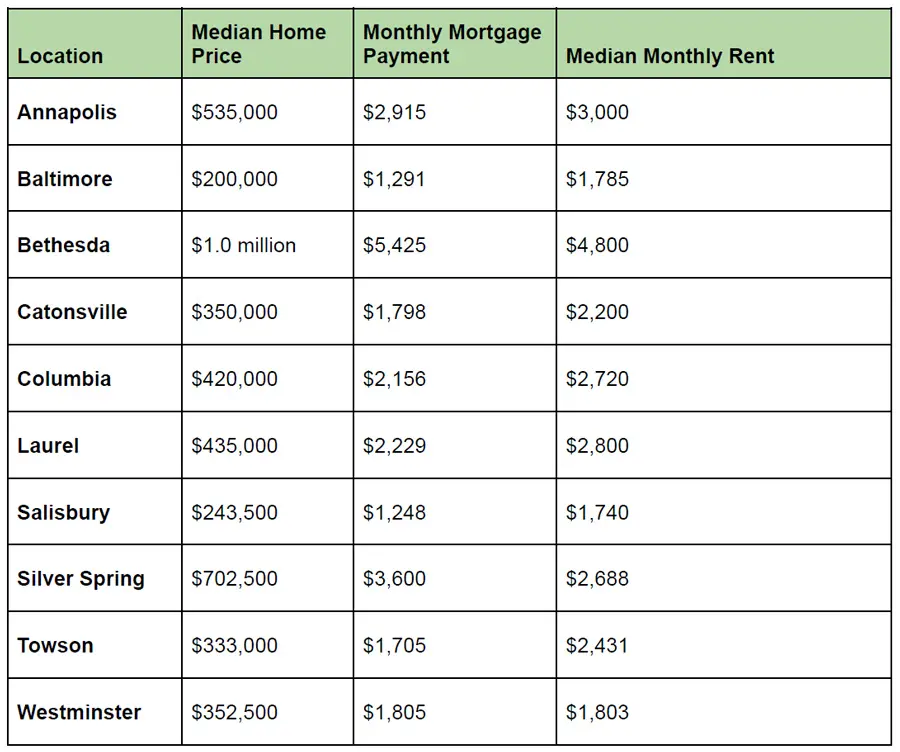

Explore the table below to analyze the monthly costs of homeownership versus renting in various Maryland cities, based on median sale and rental prices for 3-bedroom homes. Mortgage payments are calculated based on a 30-year fixed mortgage at a rate of 7.25% and a 20% down payment. Beyond immediate expenses, consider the long-term benefits, such as building equity in your property—a wise investment whether you’re committed to Maryland for the long term or not. Many regions in Maryland boast strong property value growth, making homeownership a smart move for wealth accumulation.

Note: Median home prices sourced from reporting by Zillow and RocketHomes Market Reports.

Plan Your Path to Homeownership with SECU

For Maryland millennials eyeing homeownership, the rental market offers a strategic pathway to saving. In areas like Baltimore, Silver Spring, and Laurel, where rental prices are stable or declining, renters can allocate their finances wisely to accumulate savings over time.

Ready to take the next step toward your homeownership goals? Connect with SECU’s local financial wellness experts today. Our team is equipped with the knowledge and expertise to guide you through the financial aspects of your home-buying journey, ensuring you make informed decisions that align with your aspirations and budget. Reach out now to start your journey towards homeownership with confidence.